cash flow return on assets formula

The capital invested is defined as the equity capital and preferred shares. The following formula is used to calculate it.

Weighted Average Cost Of Capital Wacc Excel Formula Cost Of Capital Excel Formula Stock Analysis

To calculate the cash flow return on sales we must first convert the net income figure into an approximation of cash flows by adding back non-cash expenses though this does not factor in changes in working capital or fixed assets and divide by net sales for the measurement period.

. Cash Flow to Sales 136200000 11600000 350400000. Operational cash flow and average value of all assets. The cash return on assets ratio of 10 might be high in one industry but very low in another.

The cash flow on total assets ratio is calculated by dividing cash flows from operations by the average total assets. Cash-on-cash yield also refers to the total amount of distributions paid annually by an. Calculation formula Cash return on capital invested is calculated by dividing the earnings before interest taxes depreciation and amortization by the total capital invested.

And one of the simplest ways to measure cash flow is a formula called the cash-on-cash return CoC for short. The measure is usually derived in aggregate for an entire business in which case the calculation is to divide the total average assets into the cash flow from operations. The formula for cash return on assets ratio requires two variables.

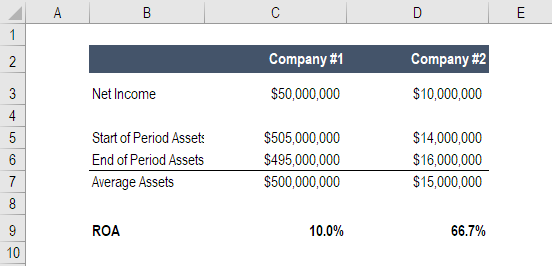

Net income Total average assets Cash return on assets The answer tells financial analysts how well a company is managing assets. ROI Investment Gain Investment Base. Cash Return on Capital Invested EBITDA Capital Invested.

Operating Cash Flow Operating Income Depreciation Taxes Change in Working Capital. For example pretend Sam and Milan both start hot dog stands. Sam spends 1500 on a bare.

Cash Ratio Cash. Cash-on-cash yield is a basic calculation used to estimate the return from an asset that generates income. Free Cash Flow Net income DepreciationAmortization Change in Working Capital Capital Expenditure.

CFROI Cash Flow Market Value of Capital Employed. The Return on Assets ROA ratio shows the relationship between earnings and asset base of the company. Return on Assets frac Net Income Total Assets Return on Assets T otal AssetsN et I ncome.

In this article Ill explain what cash-on-cash return is when to use it and when not to and how cash-on-cash return compares with other popular formulas like cap rate and ROI. Cash Flow on Total Assets Ratio Formula. The more value that a company can extract from the assets on its balance sheet the more efficient the company operates since its assets are being utilized at near full capacity to.

In the calculation the cash flow from operations figure comes from the statement of cash. Example The cash flow to total asset. Is the net cash flow from operating activities in the statement of cash flow.

Now lets use our formula. ROA Formula Return on Assets Calculation. The cash return on assets ratio varies by industry.

Net Working Capital NWC Revenue. Return on Assets Earnings Asset Base. The formula is as follows.

Net profit Non-cash expenses Total net sales. The higher the ratio the better it is. In this case Whimwick Studios would have a Cash Flow to Sales Ratio of 35 for 2019.

Cash flow return on investment can be compared with the hurdle rate which is referred to the sum of capital that is calculated by adding up the cost of debt financing and return on the equity of the investment. Return on Assets ROA Formula. Cash Flow Forecast Beginning Cash Projected Inflows Projected Outflows Ending Cash.

C a s h F l o w o n T o t a l A s s e t s C a s h F l o w f r o m O p e r a t i o n s A v e r a g e T o t a l A s s e t s. Find out more about free cash flow the formula for calculating free cash flow and how to calculate a companys free cash flow using Microsoft Excel. Cash Flow Return on Investment formula CFROI Formula Operating Cash Flow OCF Capital Employed To be able to calculate CFROI we need to understand both OCF and CE.

Return on Assets ROA is a type of return on investment ROI ROI Formula Return on Investment Return on investment ROI is a financial ratio used to calculate the benefit an investor will receive in relation to their investment cost. The term ROA stands for R eturn o n A ssets and is a commonly used metric for tracking how efficiently a company can put its assets to use to produce more net profits. Cash flow from operations.

Excluding cash equivalents less current operating liabilities ie. In other words ROA tells analysts how much each dollar of. It is most commonly measured as net income divided by the original capital cost of the.

The simplest way to think about the ROI formula is taking some type of benefit and dividing it by the cost. The first version of the ROI formula net income divided by the cost of an investment is the most commonly used ratio. Cash flow from operations Total average assets Cash return on assets.

Cash flow on total assets is an efficiency ratio that rates actually cash flows to the company assets without being affected by income recognition or income measurements. Education General Dictionary Economics Corporate Finance Roth IRA Stocks Mutual Funds ETFs 401k InvestingTrading Investing Essentials. Net working capital NWC is equivalent to current operating assets ie.

Sales We can apply the values to our variables and calculate Cash Flow to Sales Ratio. Some calculations may include intangible assets while some others may exclude them from calculation of Return on Assets.

Cash Flow Formula How To Calculate Cash Flow With Examples Positive Cash Flow Cash Flow Formula

17 Major Mergers And Acquisitions Powerpoint Templates For Every Business In 2021 Cash Flow Statement Financial Analysis Blog Titles

Financial Ratios Statement Of Cash Flows Accountingcoach Financial Ratio Cash Flow Statement Debt To Equity Ratio

Top 40 Metrics Key Performance Indicators And Dashboard Ppt Templates For Every Business Budget Forecasting Key Performance Indicators Financial Statement Analysis

Return On Assets Roa Double Entry Bookkeeping

Financial Metrics Pro Teaching Handbook Tutorial Templates Spreadsheet Template Financial Return On Assets

Inventory Turnover Analysis Templates 13 Free Xlsx Docs Inventory Turnover Financial Statement Analysis Analysis

Cash Flow Formula How To Calculate Cash Flow With Examples

Return On Assets Managed Roam Return On Assets Asset Financial Management

Financial Ratios And Formulas For Analysis In 2021 Financial Ratio Return On Assets Financial

Profitability Ratios Financial Analysis Fundamental Analysis Financial Ratio

Financial Statement Analysis Ratio Analysis Comprehensive Guide Financial Statement Analysis Financial Statement Analysis

Analysis For The Investor Mgt537 Lecture In Hindi Urdu 20 Youtube In 2022 Financial Statement Investment Analysis Fundamental Analysis

Return On Assets Roa Formula Calculation And Examples

Financial Ratio Calculator Financial Ratio Financial Statement Analysis Financial Analysis

Ratios Rule But Do You Know Which Financial Ratios To Watch Financial Ratio Medical School Stuff Financial

How Dupont Analysis Is An Essential Tool To Measure Profitability Cfa Level 1 Dupont Analysis Analysis Financial Analyst

Financial Ratios And Formulas For Analysis Financial Ratio Financial Statement Analysis Accounting Basics